Exness offers fast and secure withdrawal methods, including bank cards, e-wallets, and cryptocurrencies, with most processed instantly. Traders can access funds quickly, often within seconds, making it ideal for active trading. The minimum withdrawal varies by method, starting at $1 for some e-wallets. Ensure your account is verified to avoid delays and use the same method as your deposit for compliance. Check third-party fees, as Exness charges none. Monitor your Personal Area for transaction status. For smooth withdrawals, confirm payment details and maintain sufficient account balance before requesting funds.

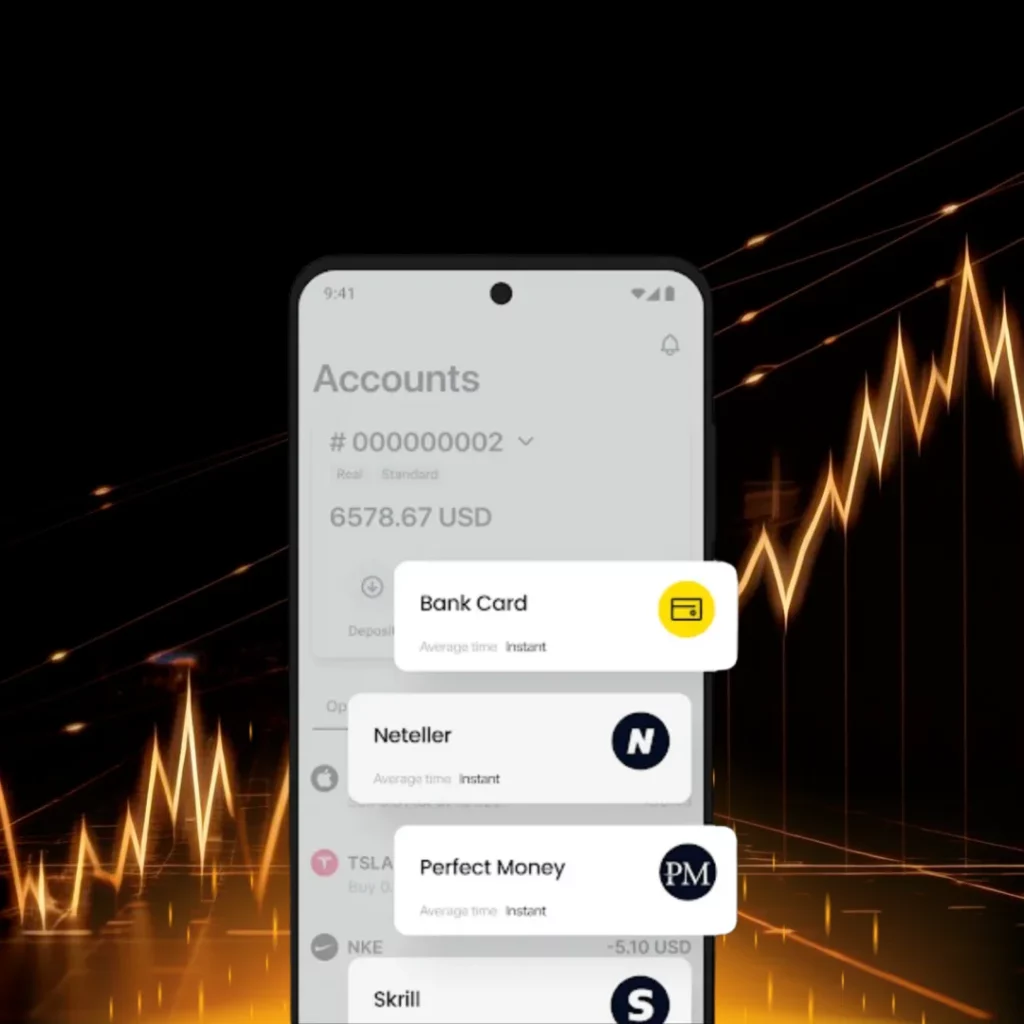

Exness Available Withdrawal Methods

Exness supports multiple withdrawal options, such as bank cards (Visa, Mastercard), e-wallets (Skrill, Neteller, Perfect Money), bank transfers, and cryptocurrencies like Bitcoin and USDT. Each method has specific minimums, like $10 for cards and $1 for e-wallets, with no Exness fees, though third-party charges may apply. Cryptocurrency withdrawals are available 24/7, ideal for global traders. Choose a method matching your deposit to ensure compliance and faster processing. Always verify your account and check currency compatibility to avoid conversion costs.

Step-by-Step Guide to Withdraw Funds from Exness

Withdrawing funds from Exness is quick and secure, requiring a verified account. The process is managed through the Personal Area, with most methods processing instantly.

- Log in to your Exness Personal Area.

- Navigate to the “Withdrawal” section.

- Select the same payment method used for deposits.

- Enter the withdrawal amount and confirm details.

- Complete any security checks, like 2FA.

Ensure your account is fully verified with ID and proof of residence to prevent delays. Use the Exness Trade app for easy monitoring of withdrawal status. Double-check payment details to avoid errors. Withdrawals must match deposit methods to comply with regulations.

Exness Withdrawal Processing Times

Exness processes most withdrawals instantly, with e-wallets like Skrill and Neteller often completed in seconds, while bank cards may take up to 3-5 business days. Cryptocurrency withdrawals, such as Bitcoin, typically process within hours, depending on blockchain confirmation times. Bank transfers can take 1-3 days, varying by region and bank. To speed up withdrawals, verify your account early and ensure sufficient funds. Check your payment provider’s terms for any additional processing delays or fees.

Withdrawal Limits and Fees

Exness offers flexible withdrawal limits and a fee-free structure, making it easy for traders to access funds. Minimum and maximum withdrawal amounts vary by payment method, and while Exness charges no fees, third-party providers may apply costs.

Common Exness Withdrawal Issues and Solutions

Exness withdrawals are generally fast, but issues like delays or rejections can occur due to verification or payment errors. Most problems have simple fixes to ensure smooth access to funds.

| Issue | Solution |

| Incomplete Verification | Submit valid ID and proof of residence to verify your account fully. |

| Mismatched Payment Method | Use the same method as your deposit to comply with Exness regulations. |

| Incorrect Details | Double-check bank account, wallet address, or card details before submitting. |

| Transaction Timeout | Maintain a stable internet connection and complete the request without exiting. |

| 3D Secure Error | Enter the correct OTP sent to your phone or email for card withdrawals. |

To prevent issues, verify your account early and ensure payment details match your deposit method. Use the Exness Personal Area to track transaction status and avoid errors. For Zero Spread Account users, test small withdrawals to confirm setup. Contact support immediately if issues persist, providing transaction IDs.

Tips for Faster and Smoother Withdrawals

Exness withdrawals can be streamlined by fully verifying your account with ID and proof of residence before requesting funds, as unverified accounts face delays or restrictions. Use e-wallets like Skrill or Neteller for instant processing, and ensure withdrawals match your deposit method to comply with regulations. Keep your account currency consistent to avoid conversion fees, and check third-party provider terms for potential charges. For Zero Spread Account users, monitor commission costs to maintain sufficient balance for withdrawals. Regularly review transaction history in the Personal Area and enable 2FA for security.

How to Contact Exness Customer Support

Exness offers 24/7 customer support in over 14 languages to resolve withdrawal or trading issues quickly. Contact options include live chat, email, and phone, accessible via the Exness website or app.

- Visit the Exness website or open the Exness Trade app.

- Click “Help” or “Support” in the Personal Area.

- Choose live chat, email ([email protected]), or phone (numbers vary by region).

- Provide your account number and issue details for faster assistance.

Live chat is the quickest way to get help, often resolving issues in minutes. Include transaction IDs or screenshots when contacting support for faster resolution. Support is available in languages like English, Arabic, and Chinese, but response times may vary during peak hours. Save correspondence for reference if issues escalate.

User Experiences with Exness Withdrawals

Exness users often share positive feedback about the platform’s withdrawal process, praising its speed and reliability. Many report receiving funds within hours, especially when using e-wallets like Skrill or Neteller, though bank transfers may take 1-3 business days. The platform supports multiple payment methods, including cryptocurrencies, which users find convenient for quick transactions. Clear instructions and responsive customer support help resolve issues fast, making withdrawals efficient for most traders. However, some users mention occasional delays during high-volume periods, so timing requests strategically can improve the experience.

Exness Account Verification and Its Grace Period

Exness requires account verification to ensure security and compliance. You must submit identity documents, like a passport or driver’s license, and proof of address, such as a utility bill. The grace period for verification is typically 30 days after account creation, during which you can trade but face withdrawal limits until verified.

To verify your Exness account, follow these steps based on the platform’s requirements:

- Log In to Your Exness Account: Access your personal area on the Exness website or app.

- Navigate to Verification Section: Find the “Verification” or “Profile” tab in your account dashboard.

- Submit Identity Proof: Upload a clear, valid document like a passport, driver’s license, or national ID. Ensure the document shows your full name, photo, and date of birth.

- Provide Address Proof: Upload a recent utility bill, bank statement, or similar document (dated within the last 6 months) showing your name and residential address.

- Ensure Document Clarity: Use high-quality scans or photos where all details are legible, without blurs or obstructions.

- Submit and Wait: After uploading, Exness typically reviews documents within 24-48 hours. You’ll receive a confirmation email once approved.

- Check Status: Monitor the verification status in your account dashboard. If rejected, review feedback and resubmit corrected documents.

To avoid delays, upload clear, high-quality documents that meet Exness’s requirements. Double-check that your details match across all submissions to prevent rejections. If issues arise, contact support promptly for guidance. Completing verification early ensures uninterrupted access to trading and withdrawals.