Exness stands out as a trusted forex broker, offering reliable trading platforms, tight spreads, and fast execution for traders worldwide. With a user-friendly interface, diverse account types, and robust security, it suits both beginners and seasoned traders. Regulated by multiple authorities, including CySEC and FCA, Exness ensures safety and transparency. Its low-cost trading, instant withdrawals, and 24/7 support make it a practical choice. Whether you’re new to forex or a professional, Exness provides tools and conditions to meet your needs, making it worth considering for your trading goals.

Why Choose Exness for Forex Trading?

Exness offers competitive spreads starting at 0.0 pips, fast order execution, and a variety of account types, including Standard, Pro, and Raw Spread accounts. Traders benefit from no requotes, high leverage up to 1:2000, and access to over 120 currency pairs. The broker’s commitment to transparency, with real-time market data and no hidden fees, builds trust. Practical features like instant withdrawals and multilingual support make Exness a strong choice for traders seeking efficiency and flexibility in their forex trading.

Exness Trading Platforms

Exness provides a range of platforms tailored to different trading styles. From industry-standard MetaTrader to its proprietary mobile app, each platform offers unique tools for effective trading.

MetaTrader 4 (MT4)

MetaTrader 4 remains a popular choice for forex traders due to its reliability and widespread use. It offers a simple interface and powerful tools for market analysis.

- Customizable charts and technical indicators

- Automated trading with Expert Advisors (EAs)

- Fast execution and real-time quotes

- Supports multiple order types

MT4 is ideal for traders who value simplicity and functionality. Its charting tools help analyze market trends, while EAs allow automated strategies. Exness ensures low latency and stable connections, making MT4 practical for both manual and algorithmic trading. The platform’s flexibility suits beginners and experts alike.

MetaTrader 5 (MT5)

MetaTrader 5 builds on MT4’s foundation, offering advanced features for multi-asset trading. It supports forex, stocks, and commodities with improved performance.

- Enhanced charting with 21 timeframes

- Built-in economic calendar

- Advanced order types, including netting and hedging

- Improved strategy tester for EAs

MT5 is suited for traders wanting deeper market analysis and broader asset access. Its upgraded tools, like the economic calendar, help track market events. Exness optimizes MT5 for fast execution and reliability, making it a strong choice for diversified trading strategies.

Exness Trade App

The Exness Trade App brings trading to your mobile device with a focus on convenience. It’s designed for traders who need flexibility on the go.

- Real-time market updates and price alerts

- One-tap trading and account management

- Secure login with biometric authentication

- Instant deposits and withdrawals

The Exness Trade App is perfect for traders who prioritize mobility without sacrificing functionality. It offers quick access to markets, allowing users to manage trades and monitor accounts anywhere. The app’s intuitive design ensures easy navigation, making it practical for beginners and active traders.

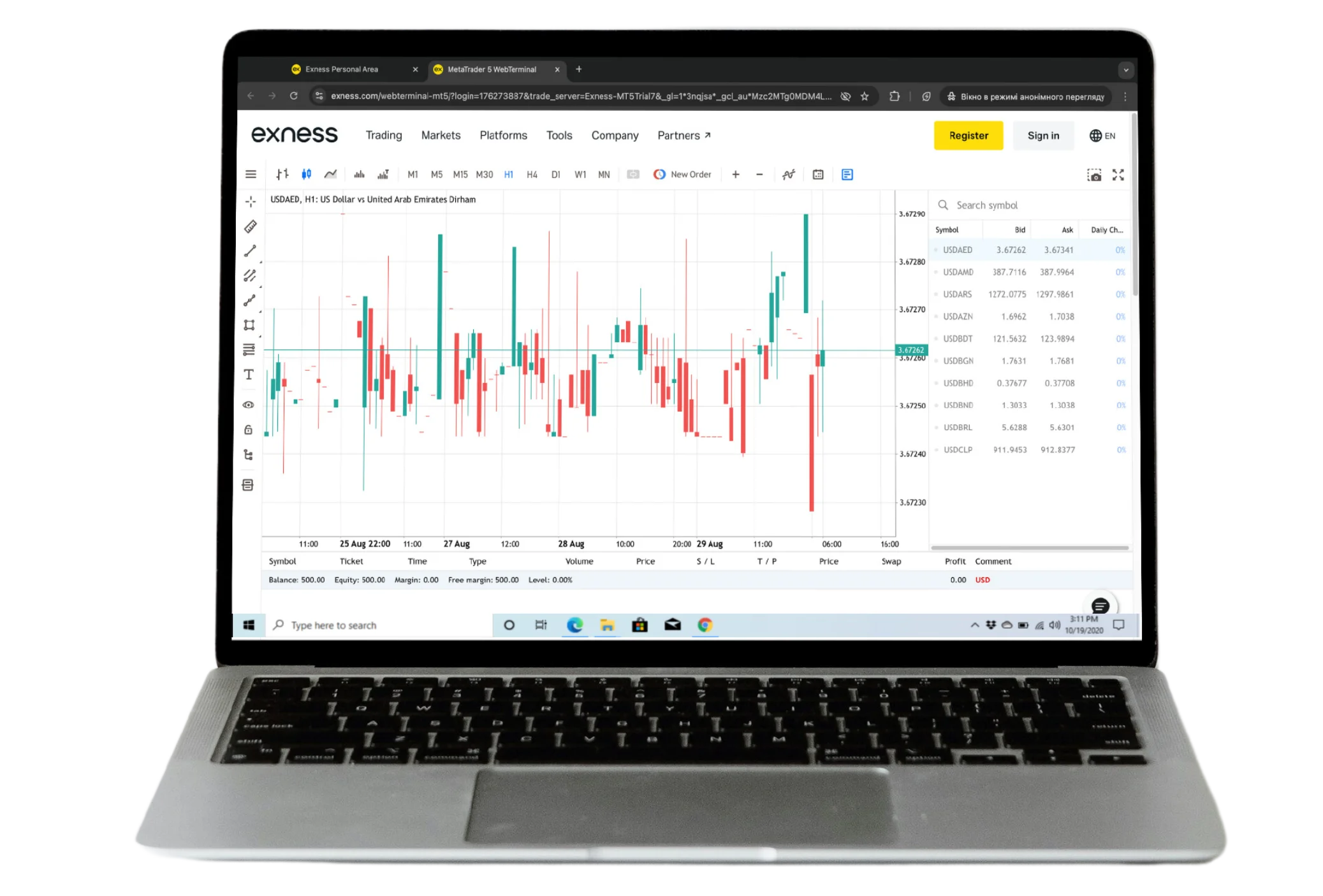

Exness Terminal and MT WebTerminal

Exness Terminal and MT WebTerminal provide browser-based trading without software downloads. These platforms offer flexibility for traders who prefer web access.

- No installation required

- Real-time market data and analysis tools

- Compatible with MT4 and MT5 accounts

- Accessible on any device with a browser

These web-based platforms are ideal for traders who switch devices or avoid downloads. Exness Terminal offers a clean interface for quick trades, while MT WebTerminal mirrors desktop features. Both ensure secure, fast trading, making them practical for users seeking convenience and performance.

Registering with Exness

Signing up with Exness is a quick and secure process designed for traders of all levels. The registration takes just a few minutes and grants access to a Personal Area for managing trades.

- Visit the Exness website or download the Exness Trade app.

- Click “Sign Up” and enter your email, phone number, and country.

- Create a secure password and agree to the terms.

- Confirm your email and phone number via verification codes.

Exness makes registration straightforward, requiring only basic personal details to get started. Ensure your email and phone number are active, as they’re used for verification and account recovery. Once registered, you can access trading platforms like MT4, MT5, or the Exness Trade app. For security, enable two-factor authentication (2FA) after signing up.

Exness Account Verification

Verifying your Exness account is essential to unlock full trading features and lift deposit limits. The process ensures compliance with regulations and protects your funds.

- Log in to your Exness Personal Area (PA).

- Go to the “Complete Profile” section and select “Verify Profile.”

- Submit Proof of Identity (POI), like a passport or ID card.

- Upload Proof of Residence (POR), such as a utility bill or bank statement (not older than 6 months).

- Answer questions about your income source and trading experience.

Verification typically completes within minutes but may take up to 24 hours for manual checks. Accurate document submission, matching your registration details, prevents delays. Exness accepts high-resolution scans or photos for POI and POR. Unverified accounts face deposit and trading restrictions after 30 days.

Logging in to Your Exness Account

Logging into your Exness account is simple and secure, giving you access to your Personal Area. The process works across the website, app, or trading platforms.

- Go to the Exness website or open the Exness Trade app.

- Enter your registered email and password.

- Complete two-factor authentication (2FA) if enabled.

- Select your trading account (real or demo) to start.

The Exness Personal Area lets you manage accounts, deposits, and withdrawals efficiently. Always check your login credentials and ensure 2FA is active for added security. If you don’t receive the 2FA code, verify your phone settings or contact support. For platform-specific logins (e.g., MT4/MT5), use your account number and server details.

Exness Minimum Deposit Requirements

Exness offers flexible deposit requirements, starting as low as $10 for Standard and Standard Cent accounts, depending on the payment method. Professional accounts, like Pro, Raw Spread, or Zero, require a minimum of $200. The exact amount may vary by region and payment system, such as bank transfers, cards, or e-wallets like Skrill.

Exness does not charge deposit fees, but third-party providers may apply charges. Traders should confirm payment-specific minimums to avoid surprises.

- Log in to your Exness Personal Area.

- Navigate to the “Deposit” section.

- Choose a payment method (e.g., card, bank transfer, e-wallet, or crypto).

- Enter the deposit amount, ensuring it meets the method’s minimum.

- Verify transaction details and confirm the deposit.

For Standard Cent accounts, you can start trading with just a few dollars, ideal for beginners. Professional accounts require higher deposits but offer tighter spreads and advanced features. Always match the deposit currency to your account’s base currency to avoid conversion fees. Instant deposit methods like cards or e-wallets suit active traders, while bank transfers may take 1-3 days. Check payment provider terms for any additional costs.

Account Types Tailored to Your Needs

Exness offers a variety of account types designed to match different trading styles and experience levels. From beginner-friendly options to advanced accounts for professionals, each comes with unique features to suit specific needs.

Funding Your Exness Trading Account

Exness offers a variety of secure and fast methods to fund your trading account. Deposits are processed instantly for most payment options, ensuring quick access to trading.

- Log in to your Exness Personal Area.

- Select “Deposit” and choose a payment method (e.g., bank card, e-wallet, crypto).

- Enter the deposit amount and confirm transaction details.

- Complete the payment process via the chosen provider.

Most deposit methods, like cards or e-wallets, are instant, allowing immediate trading. Ensure the payment method matches your account’s base currency to avoid conversion fees. Minimum deposits start at $10 for Standard accounts, but check method-specific limits. Exness does not charge deposit fees, though third-party providers might.

Withdrawing Funds from Your Exness Account

Exness provides fast and secure withdrawal options, with many processed instantly. Withdrawals must use the same method as deposits for security and compliance.

- Access your Exness Personal Area and select “Withdrawal.”

- Choose the same payment method used for deposits.

- Enter the withdrawal amount and verify details.

- Confirm the request and complete any additional security checks.

Exness processes most withdrawals within seconds, though bank transfers may take 1-3 days. Ensure your account is verified to avoid delays. Withdrawals are free of Exness fees, but third-party charges may apply. Check your payment provider’s terms and maintain sufficient account balance for trading.

Commissions at Exness

Exness keeps trading costs low, with no commissions on Standard and Standard Cent accounts, making them ideal for beginners. Pro accounts also avoid commissions on most instruments, offering tight spreads from 0.1 pips for cost-effective trading. Raw Spread and Zero accounts incur commissions (up to $3.50 per lot per side and from $0.05 per lot, respectively) but provide ultra-low or zero spreads for high-volume traders. Commission rates are transparent and depend on the instrument and account type. Traders can view costs in the Personal Area or platform, ensuring clarity.

Trading Instruments Available at Exness

Exness offers a broad range of trading instruments, covering forex, commodities, indices, stocks, cryptocurrencies, and more as CFDs. Traders can diversify their portfolios across multiple asset classes, suitable for both short-term and long-term strategies. These instruments are accessible on platforms like MT4, MT5, and the Exness Trade app.

Traders can monitor these instruments using real-time charts on MT5 or set price alerts on the Exness Trade app. Leverage varies by asset (e.g., up to 1:2000 for forex, 1:20 for cryptocurrencies), so adjust risk settings carefully. Check trading hours, as forex and cryptos differ from stocks or bonds, which follow exchange schedules.

What Traders Say: Exness Review on Trustpilot

Exness maintains a 4-star rating on Trustpilot from over 17,000 reviews, with traders praising its fast execution, zero spreads on the Zero Spread Account, and instant withdrawals. Users value the intuitive Exness Trade app and 24/7 multilingual support, but some mention occasional withdrawal delays or leverage adjustments, recommending regular account checks. Specific feedback includes:

John M. (May 15, 2025) said, “Exness is great for scalping with zero spreads, but commissions can add up if you trade big volumes.”

Sarah K. (April 22, 2025) noted, “Withdrawals are super fast, but support was slow during a volatile market.”

Ahmed R. (March 10, 2025) commented, “MT5 runs smoothly for forex and crypto, but more tutorials would help new traders.”

To optimize your trading, practice on a demo account, verify your account early for seamless withdrawals, and monitor commission costs in the Personal Area.

Exness Licenses and Regulation

Exness operates under multiple regulatory licenses, ensuring a secure trading environment for its clients. It is authorized by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) for institutional clients, while retail traders are served by entities regulated by the Financial Services Authority (FSA) in Seychelles, the Financial Sector Conduct Authority (FSCA) in South Africa, the Capital Markets Authority (CMA) in Kenya, and others. These regulators enforce strict financial standards, including segregated client funds and transparent operations. Regular audits by Deloitte further enhance trust.

Exness Office Locations

Exness maintains a global presence with registered entities across multiple regions, ensuring localized support and compliance with regional regulations. Each office serves specific client needs, from customer support to regulatory adherence.

- Exness CY Ltd: Porto Bello, 1 Siafi Street, Office 401, 3042, Limassol, Cyprus

- Exness (SC) Ltd: F20, 1st Floor, Eden Plaza, Eden Island, Seychelles

- Exness ZA (Pty) Ltd: Offices 307 & 308, Third Floor, North Wing, Granger Bay Court, V&A Waterfront, Cape Town, South Africa

- Exness BV (Curaçao): Emancipatie Boulevard, Dominico F. “Don” Martina 31, Curaçao

- Exness UK Ltd: 107 Cheapside, London, EC2V 6DN, United Kingdom

- Exness (VG) Ltd: Trinity Chambers, P.O. Box 4301, Road Town, Tortola, British Virgin Islands

- Exness (KE) Ltd: The Courtyard, 2nd Floor, General Mathenge Road, Westlands, Nairobi, Kenya

These office locations reflect Exness commitment to serving clients globally while adhering to local regulatory requirements. Traders can contact the relevant office for support or inquiries, with most offering multilingual assistance. Verify which entity your account is registered under to understand applicable regulations and support channels. Note that some offices, like those in Seychelles or BVI, primarily handle retail accounts, while Cyprus and UK offices focus on institutional clients.

Is Exness Right for You?

Exness is a solid choice for traders of all levels due to its low-cost structure, with spreads from 0.0 pips and flexible account types like Standard ($10 minimum deposit) and Zero for professionals. Beginners benefit from the user-friendly Exness Trade app and demo accounts, while experienced traders appreciate fast execution, high leverage up to 1:2000, and access to over 100 forex pairs, stocks, and cryptocurrencies. Regulated by authorities like FCA, CySEC, and FSA, it ensures fund safety and transparency. However, traders in regions with stricter regulations should confirm the entity they’re registered under, as offshore licenses may offer less oversight.

Trading Tools and Educational Resources

Exness equips traders with practical tools like the economic calendar, currency converter, and VPS hosting for uninterrupted trading, available on MT4, MT5, and the Exness Terminal. Its educational resources include webinars, market analysis, and trading tutorials tailored for beginners to advanced users, accessible via the Exness Academy. The Social Trading platform lets novices copy expert strategies, while the investment calculator helps plan trades. These tools support informed decision-making, but traders should regularly practice on demo accounts to test strategies and stay updated with market insights to maximize their effectiveness.