An Exness Islamic account offers Muslim traders a Sharia-compliant way to trade forex, commodities, and more without interest-based fees. It removes swap charges, aligning with Islamic finance principles that prohibit riba (interest). With competitive spreads and access to global markets, it suits both beginners and experienced traders. It allows trading in a way that respects religious beliefs while maintaining fast execution and diverse instruments. This account type ensures ethical investing, making it a popular choice for those seeking halal financial opportunities.

What Is an Exness Islamic Account?

An Exness Islamic account is a swap-free trading account designed for Muslim traders to comply with Sharia law. It eliminates interest fees on overnight positions, ensuring no riba is involved. Traders can hold positions long-term without worrying about hidden charges, making it ideal for ethical forex and CFD trading.

Key Features of Exness Islamic Accounts

Exness Islamic accounts provide a transparent, Sharia-compliant trading experience. They offer the same conditions as standard accounts but without swap fees. Traders benefit from fast execution and flexible leverage.

- No Swap Fees: Hold positions overnight without interest charges.

- Sharia Compliance: Adheres to Islamic finance principles, avoiding riba and gharar.

- Diverse Instruments: Trade forex, metals, indices, and commodities.

- Competitive Spreads: Low spreads for cost-effective trading.

Practically, these accounts suit scalpers and long-term traders alike. The absence of swaps ensures cost clarity, while access to MT4 and MT5 platforms supports advanced strategies. Traders can diversify portfolios while staying aligned with faith-based values. Always check instrument-specific spreads, as they vary by market conditions.ess company, contact us through one of the available communication channels. Or you can find this information directly on our website: navigate through the menu and click on the tab of your interest.

How to Open an Islamic Account on Exness

Opening an Exness Islamic account is quick and user-friendly. It requires a few steps to set up a Sharia-compliant trading profile.

Step-by-Step Registration

Registering for an Exness Islamic account takes just minutes. Begin on the official Exness website and select the Islamic option. Verify your identity to activate the account.

- Visit the Exness website and click “Open Account.”

- Fill in your details: name, email, and country.

- Choose “Islamic Account” during account type selection.

- Upload ID (passport or national ID) and proof of address (utility bill).

- Wait for verification, usually completed within 1-2 days.

- Deposit funds to start trading.

Practically, ensure your documents are clear to speed up verification. The process is secure, meeting global regulations. Once approved, you can trade immediately with swap-free conditions. Check your account settings to confirm Islamic status is active.

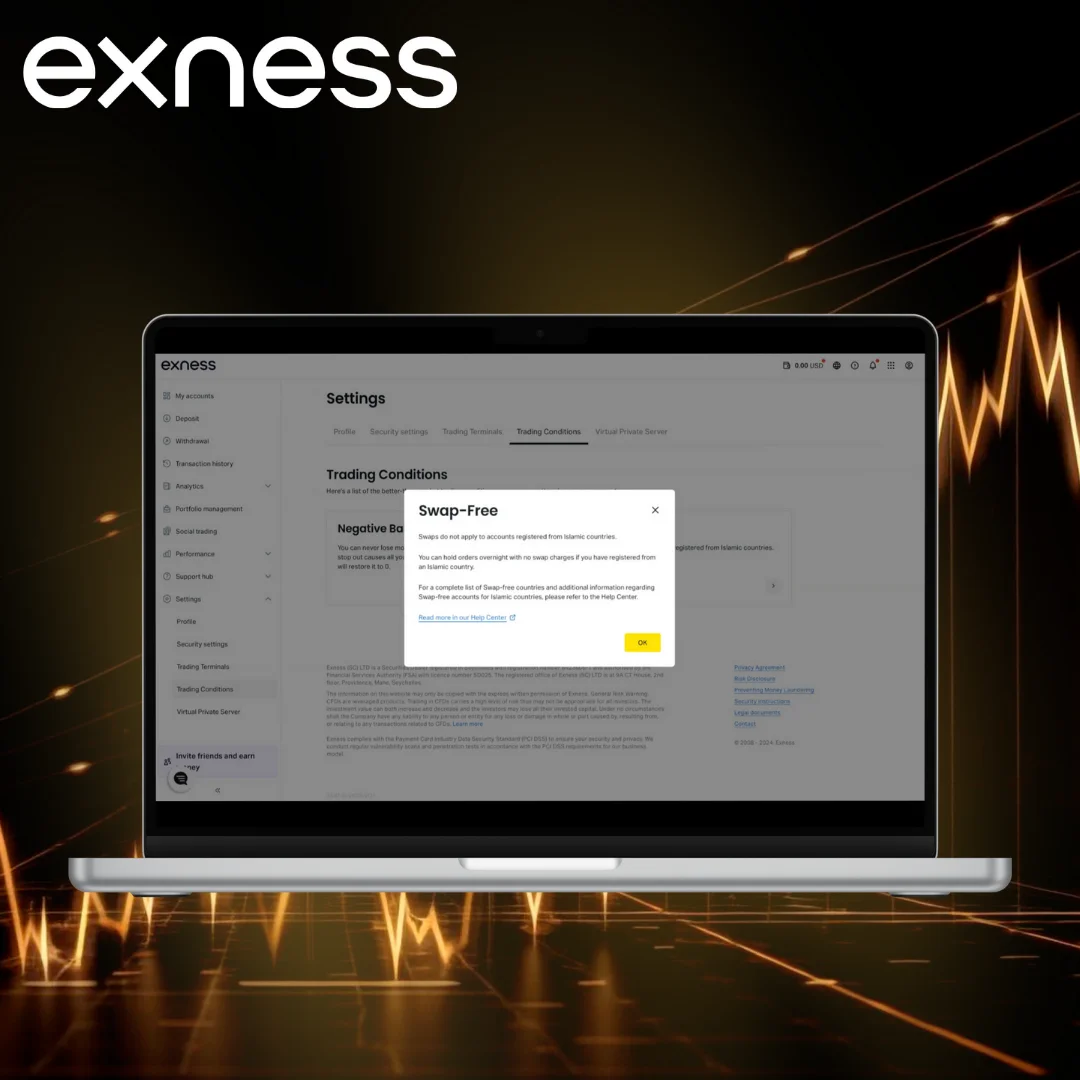

Converting Existing Accounts

If you already have an Exness account, switching to an Islamic account is simple. Log into your Personal Area, go to account settings, and select the swap-free option. If unavailable, contact customer support to request conversion. They’ll verify eligibility and update your account, typically within a day. This is useful for traders who initially opened a standard account but now prefer Sharia-compliant trading. Ensure your account meets Exness’s terms to avoid delays.

Funding Options

Exness Islamic accounts support multiple deposit methods for flexibility. Options include bank transfers, credit/debit cards, e-wallets, and cryptocurrencies like Bitcoin. Deposits are usually instant for cards and e-wallets, while bank transfers may take 3-5 days. No deposit fees are charged by Exness, but your bank or provider might apply charges. Choose a method in your local currency to avoid conversion costs. Withdrawals are fast, often processed instantly, giving traders control over funds. Always verify minimum deposit requirements, starting at $10 for some methods.

Principles of Islamic Finance in the Context of Trading

Islamic finance in trading follows Sharia principles, emphasizing fairness and prohibiting riba (interest), gharar (excessive uncertainty), and haram (forbidden) activities like gambling. In forex and CFD trading, this means avoiding swap fees on overnight positions and ensuring transparent transactions. Practically, traders using Islamic accounts can engage in global markets while adhering to ethical standards. For example, trading halal instruments like currencies or commodities is allowed, but speculative trades resembling gambling are not. This approach promotes risk-sharing and real economic activity, aligning financial goals with religious values.

Sharia Compliance and Ethical Trading

Sharia-compliant trading ensures all activities align with Islamic law, prioritizing ethical and transparent practices. Exness Islamic accounts eliminate interest-based fees, like swaps, and avoid speculative instruments that involve excessive risk or uncertainty. Practically, traders can use these accounts to invest in halal assets like forex pairs or gold while maintaining compliance. For instance, scalping or day trading is viable, as long as trades are settled promptly to avoid interest. This setup fosters trust, as traders know their investments respect their faith while offering access to competitive market conditions.

Who Can Benefit from Exness Islamic Accounts?

Exness Islamic accounts are ideal for Muslim traders seeking Sharia-compliant trading solutions, from beginners to seasoned investors. They suit those who prioritize ethical finance, avoiding interest and speculative practices. Practically, a new trader can start with a low $10 deposit to test strategies, while professionals benefit from high leverage and diverse markets like forex, metals, or indices. Non-Muslim traders may also use these accounts for swap-free benefits, especially if they hold positions long-term. This flexibility makes the account appealing for anyone valuing cost clarity and ethical trading principles.

Comparison of Exness Islamic Account with Standard Accounts

Exness Islamic accounts differ from standard accounts primarily by eliminating swap fees, ensuring Sharia compliance for Muslim traders, while standard accounts charge interest on overnight positions. Both account types offer identical access to trading platforms (MT4, MT5), instruments (forex, metals, indices), and competitive spreads. Islamic accounts may have slightly higher spreads on certain instruments to offset the absence of swaps, but they maintain the same execution speed and leverage options. Practically, Islamic account holders can trade long-term without worrying about interest costs, making them ideal for strategies like swing trading, whereas standard account users might prefer short-term trades to minimize swap fees.

Pros and Cons of Exness Islamic Accounts

Exness Islamic accounts offer unique benefits but come with some trade-offs. They cater to ethical trading needs while maintaining robust features. Consider the following before choosing:

Pros:

- No swap fees, aligning with Sharia law.

- Access to diverse markets like forex, commodities, and indices.

- Same fast execution and platform options as standard accounts.

Cons:

- Slightly higher spreads on some instruments.

- Limited availability for certain account types (e.g., ECN).

- Requires verification to confirm Islamic account status.

Practically, these accounts are excellent for traders prioritizing halal trading, especially for long-term positions. However, scalpers might notice marginally higher costs due to spread adjustments. Always compare spreads for your preferred instruments before trading. Contact Exness support to clarify eligibility or account-specific terms.